New hires and/or newly eligible Workmates have 60 calendar days to apply for

coverage up to the guarantee issue limits without any health questionnaire

Explore plan options, view rates, and apply online.

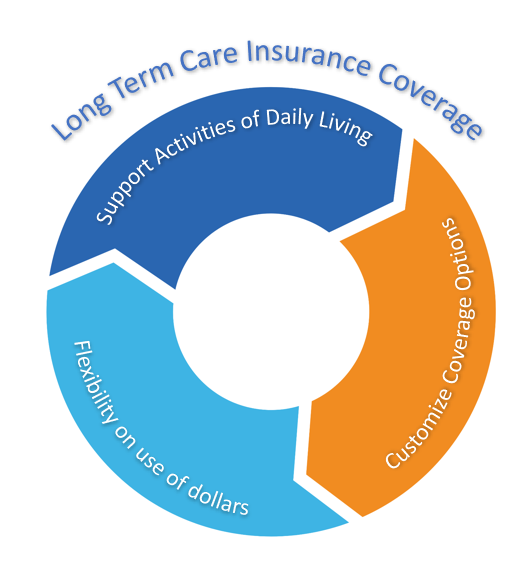

Workmates also have access to traditional LTC coverage:

- Enroll anytime (subject to the completion of a medical questionnaire)

- Coverage can be declined (except for new hires)

- Doesn't include life insurance

- Choose from a variety of options to fit your needs

- Spouses, partners, children and grandchildren can apply (ages 18-80)

Life Insurance With Long-Term Care (LTC) is Two Benefits in One Policy!

- Enroll anytime (subject to the completion of a medical questionnaire)

- Coverage can be declined (except for new hires)

Permanent life insurance:

- Permanent coverage

- Builds cash value

- Can be used to pay final expenses

- Helps protect your financial legacy

Long-term care:

- Relieves your family from becoming full-time caregivers

- Cash benefits for home and /or residential care

- Maintain control and decide where and from whom you receive care

.png)

Did you know?

72% of long-term care is publicly funded.* To address this significant budgetary burden,many states are considering implementing new programs which may include new payroll taxes,tax credits and incentives,or rate change regulation.

*Congressional Research Service, Who Pays for Long-Term Services and Supports? June 2022The following states are currently considering some sort of program to address the LTC crisis*

.png)

Attention, California Workmates!

In 2019, the California Legislature created a task force to design a state wide LTC program. One of the task force’s recommendations was the potential implementation of a new payroll tax. Depending on the legislature’s decision on any LTC bill, it’s possible that individuals in California with private LTC coverage in place prior to any legislation enacted could be exempt, in part or in full, from being subject to an additional payroll tax. Should any of the programs currently being evaluated become law, securing this coverage now may help you obtain an exemption from payroll taxes,or obtaining tax credits or deductions based on whatever may come to fruition, if anything, in California.

To learn more, visit California's Department of Insurance LTC Page

You and your family are eligible!

Outside of WA state, should any of the programs currently being evaluated become law, securing this coverage may help you obtain an exemption from payroll taxes or obtaining tax credits or deductions based on whatever comes to fruition, if anything, in any state.